The Goal of Accounting and Finance

In the world of business and finance, accounting and finance play pivotal roles in ensuring the success and sustainability of organizations. These two fields are often closely intertwined, but they have distinct objectives and functions. In this article, we will delve into the primary goals of accounting and finance, highlighting their differences and how they complement each other. What is the goal of accounting and finance?

Understanding Accounting: The Language of Business

The Role of Accounting

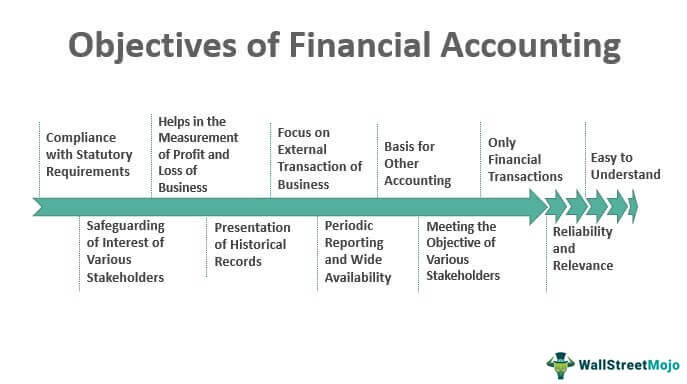

Accounting is often referred to as the “language of business” because it provides a systematic way to record, analyze, and communicate financial information. The primary goal of accounting is to provide accurate and reliable financial information to various stakeholders, including management, investors, creditors, and regulatory bodies.

What is the goal of accounting and finance?

Financial Reporting

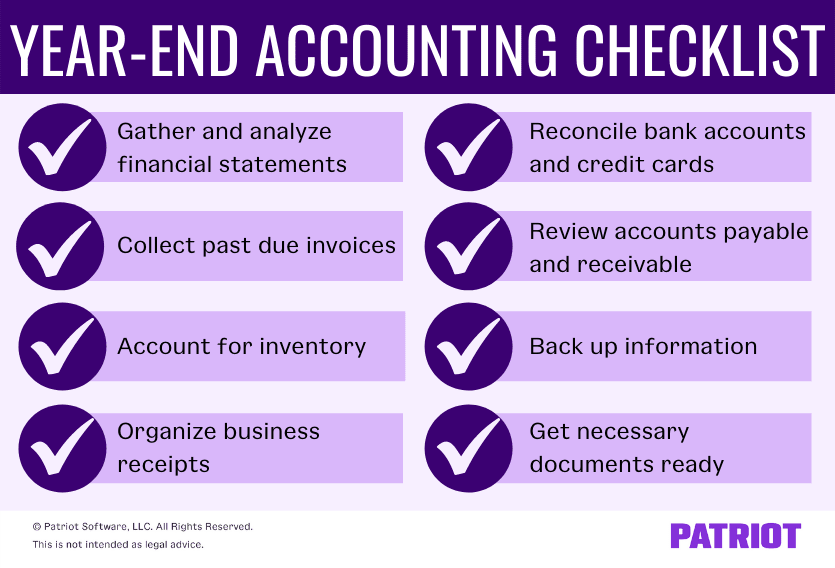

One of the core functions of accounting is financial reporting. This involves preparing financial statements, such as the balance sheet, income statement, and cash flow statement. These statements summarize an organization’s financial performance and position, allowing stakeholders to make informed decisions. Financial reporting is governed by generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS), depending on the jurisdiction.

Compliance and Transparency

Accounting also plays a crucial role in ensuring compliance with tax laws, regulations, and accounting standards. Maintaining transparency in financial reporting helps build trust with investors and creditors. It is essential for organizations to accurately report their financial information to avoid legal and financial consequences.

Decision Support

Another key goal of accounting is to provide decision support to management. Through financial analysis, managers can assess the financial health of the organization, identify areas of improvement, and make strategic decisions. Accounting information helps in budgeting, forecasting, and setting financial goals.

The Objectives of Finance

While accounting focuses on recording and reporting financial data, finance is more concerned with managing and optimizing financial resources to achieve specific objectives.

Wealth Maximization

The primary goal of finance is to maximize the wealth of shareholders or owners. This means making decisions that increase the value of the organization, leading to higher stock prices and dividends for shareholders. Wealth maximization is often achieved by making sound investment decisions and effectively managing financial resources.

Risk Management

Finance also aims to manage and mitigate financial risks. This involves identifying potential risks, such as market volatility, credit risk, and liquidity risk, and implementing strategies to minimize their impact. Effective risk management helps protect the organization’s financial stability and reputation.

Capital Allocation

Another critical objective of finance is efficient capital allocation. This entails determining how to allocate financial resources among different projects and investments. Finance professionals evaluate potential investments based on their expected returns and risk profiles, ensuring that capital is invested in projects that will generate the highest returns for the organization.

Long-Term Sustainability

Finance professionals are tasked with ensuring the long-term sustainability of the organization. This means considering the impact of financial decisions on the organization’s future viability. Sustainable finance practices take into account environmental, social, and governance (ESG) factors, as well as ethical considerations.

The Synergy Between Accounting and Finance

Collaboration Between Accounting and Finance

While accounting and finance have distinct goals and functions, they are closely interconnected. Effective financial management relies on accurate accounting data. Finance professionals use financial statements prepared by accountants to make investment decisions, assess financial health, and manage risks.

Informed Decision-Making

Accounting provides finance professionals with the necessary information to make informed decisions. For example, when evaluating investment opportunities, finance experts rely on accounting data to assess a project’s potential returns and associated risks. This synergy between accounting and finance ensures that decisions are grounded in financial reality.

Financial Planning and Budgeting

Finance and accounting work hand in hand in the budgeting and financial planning process. Accountants provide historical financial data and insights, which finance professionals use to create budgets and forecasts. This collaborative effort helps organizations set realistic financial goals and allocate resources effectively.

Regulatory Compliance

Both accounting and finance departments are responsible for ensuring regulatory compliance. Accountants maintain accurate financial records in accordance with accounting standards, while finance professionals ensure that the organization adheres to financial regulations and tax laws. Compliance is critical for avoiding legal penalties and maintaining the trust of stakeholders.

Conclusion

In summary, the goal of accounting is to provide accurate and transparent financial information, while finance focuses on maximizing wealth, managing risks, and optimizing the allocation of financial resources. Although these fields have distinct objectives, they are interdependent and essential for the success of any organization. Accounting and finance professionals must work collaboratively to make sound financial decisions that drive the organization’s growth and sustainability. By understanding the roles and goals of both accounting and finance, businesses can achieve financial prosperity and navigate the complex landscape of modern finance effectively. For CBD Tax accounting firm ashfield read here.