Understanding Business Structure in Accounting

Introduction

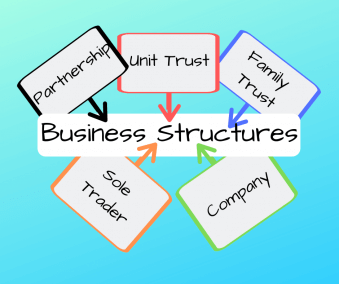

In the world of finance and accounting, understanding the concept of business structure is crucial for entrepreneurs, investors, and financial professionals alike. Business structure refers to the legal and organizational framework within which a company operates. It plays a pivotal role in determining various aspects of a business, including its tax obligations, liability, and management. In this article, we will delve into the significance of business structure in accounting, exploring different types of structures and their implications.

1. The Importance of Business Structure

1.1. Legal and Financial Implications

The choice of business structure has significant legal and financial ramifications for a company. Different structures offer varying degrees of liability protection, tax benefits, and ease of management. It is essential for entrepreneurs to carefully consider their options to select the most suitable structure for their business goals.

Sole proprietorships and partnerships provide minimal legal separation between the business and its owner(s). This means that personal assets of the business owner(s) may be at risk if the business incurs debts or faces legal issues. On the other hand, corporations and limited liability companies (LLCs) offer a higher level of protection by limiting the liability of the owners to the amount of their investment in the business.

1.2. Taxation

Taxation is another critical aspect affected by the choice of business structure. Each structure has its own tax implications, and understanding them can help business owners optimize their tax burden.

What is business structure in accounting?

Sole proprietorships and partnerships are typically pass-through entities, meaning that business income and losses flow through to the owners’ personal tax returns. In contrast, corporations are taxed separately from their owners. This leads to the concept of “double taxation,” where corporate profits are taxed at the corporate level and then again when dividends are distributed to shareholders. However, certain corporations, known as S corporations, have the advantage of pass-through taxation similar to partnerships.

2. Types of Business Structures

2.1. Sole Proprietorship

A sole proprietorship is the simplest form of business structure, where an individual operates a business as a single owner. It requires minimal paperwork and offers complete control over business decisions. However, the owner is personally liable for all business debts and obligations.

2.2. Partnership

A partnership is a business structure in which two or more individuals share ownership and responsibility for the business. There are two main types of partnerships: general partnerships and limited partnerships. In a general partnership, all partners are equally liable for the business’s debts. In a limited partnership, some partners have limited liability and are not actively involved in the business’s operations.

2.3. Corporation

A corporation is a legal entity that is separate from its owners, known as shareholders. It has its own rights, privileges, and liabilities. Corporations provide limited liability protection to their shareholders, meaning their personal assets are usually shielded from business debts. They also have a perpetual existence, unaffected by the death or departure of shareholders.

2.4. Limited Liability Company (LLC)

A Limited Liability Company (LLC) combines elements of both a corporation and a partnership. It offers limited liability protection to its members (owners) while maintaining the flexibility of a partnership. LLCs provide pass-through taxation and can have an unlimited number of members.

3. Choosing the Right Business Structure

3.1. Business Goals and Objectives

The first step in choosing the right business structure is to define the company’s goals and objectives. Considerations such as the size of the business, the number of owners, and the desired level of personal liability protection should be taken into account.

3.2. Tax Implications

Taxation is a crucial factor in the decision-making process. Entrepreneurs should assess the tax implications of each structure and determine which one aligns best with their financial situation and goals. Consulting with a tax professional can be beneficial in making an informed decision.

3.3. Liability Protection

For businesses that involve higher risks and potential legal liabilities, choosing a structure that provides limited liability protection may be essential. This ensures that personal assets are protected in the event of legal actions or debts incurred by the business. https://cbdtax.com.au/company-business-restructuring/

3.4. Future Flexibility

Consider the future growth and expansion plans of the business when selecting a structure. Some structures may be more conducive to growth and can accommodate changes in ownership and management more easily than others.

Conclusion

In summary, the business structure in accounting refers to the legal and organizational framework within which a company operates. It has far-reaching implications on taxation, liability, and management. Choosing the right structure is a crucial decision that can significantly impact a company’s financial and operational success. Entrepreneurs should carefully analyze their business goals and seek professional advice when selecting the most suitable business structure for their ventures.