Tax Brackets 2023: Understanding Income Tax Rates and Categories

As the new year rolls in, taxpayers across the nation are gearing up to understand the latest tax brackets for 2023. The tax system can be complex, with various income categories and rates. In this article, we’ll break down the tax brackets for 2023 and provide you with a clear overview of how your income is categorized and taxed.

What are Tax Brackets?

Tax brackets are the ranges of income that determine the percentage of income tax individuals and households are required to pay to the government. The tax system is progressive, which means that as your income increases, the tax rate you pay also increases. In the United States, the Internal Revenue Service (IRS) establishes these tax brackets annually, considering factors such as inflation and economic conditions.

2023 Tax Brackets and Rates

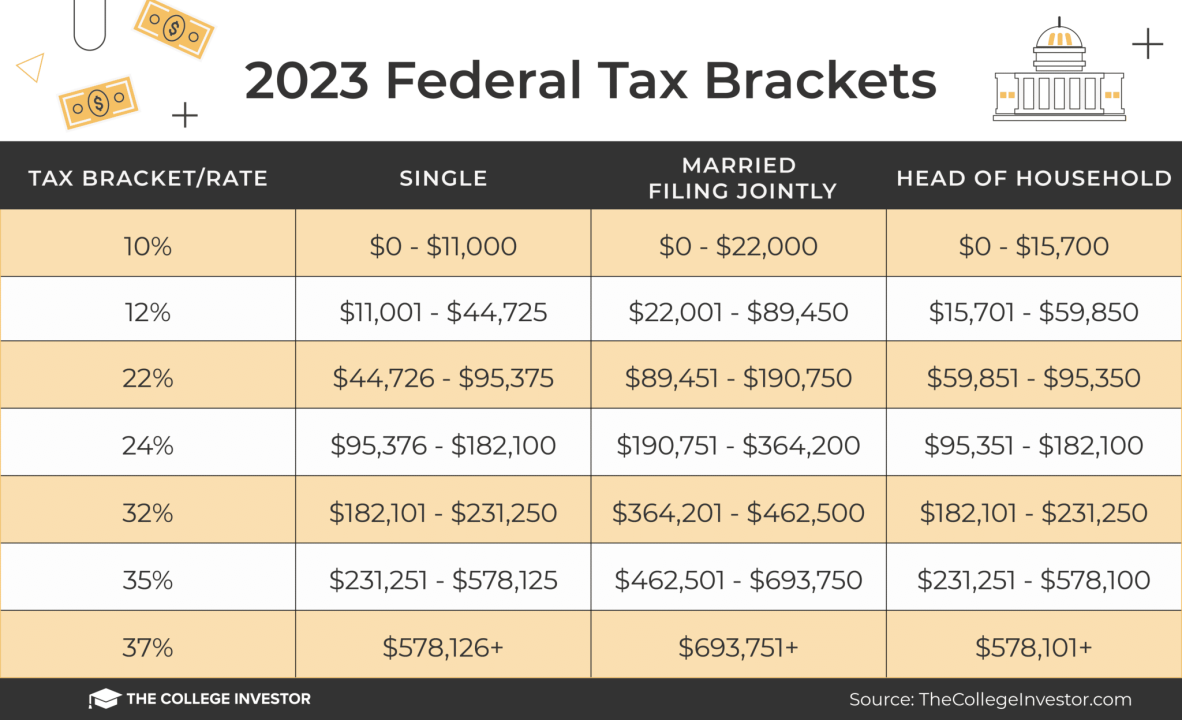

Let’s delve into the specific tax brackets for 2023:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 10% | Up to $9,950 | 10% |

| 12% | $9,951 – $40,525 | 12% |

| 22% | $40,526 – $86,375 | 22% |

| 24% | $86,376 – $164,925 | 24% |

| 32% | $164,926 – $209,425 | 32% |

| 35% | $209,426 – $523,600 | 35% |

| 37% | Over $523,600 | 37% |

It’s important to note that these tax rates apply to your taxable income, which is your total income minus any deductions and exemptions you qualify for.

How Tax Brackets Affect You

Understanding tax brackets is essential for effective financial planning. As your income increases, you might move into a higher tax bracket, which doesn’t mean that all of your income is taxed at the higher rate. Instead, only the portion of your income that falls within the higher bracket is taxed at that rate. For instance, if you’re a single filer with an income of $50,000, you won’t pay 22% on the entire amount. Instead, you’ll pay 10% on the first $9,950, 12% on the amount between $9,951 and $40,525, and 22% on the remaining $9,475.

What are the tax 2023 brackets?

Strategies for Managing Tax Liability

There are several strategies you can employ to manage your tax liability within the tax brackets:

- Take Advantage of Deductions: Deductions reduce your taxable income. Consider itemizing deductions if they exceed the standard deduction.

- Contribute to Retirement Accounts: Contributions to retirement accounts like 401(k)s and IRAs can lower your taxable income.

- Invest Wisely: Long-term capital gains often have lower tax rates. Consider holding investments for over a year to benefit from these rates.

- Explore Tax Credits: Tax credits directly reduce your tax liability. Research available credits for your situation.

State and Local Taxes

While federal tax brackets are standardized across the nation, state and local taxes vary. Some states have a flat income tax rate, while others have their own progressive tax systems with multiple brackets. Additionally, some states don’t impose income taxes at all. https://cbdtax.com.au/new-client-form/

Consult a Tax Professional

Given the complexity of the tax system and the potential impact of tax law changes, it’s advisable to consult a tax professional or financial advisor. They can provide personalized guidance tailored to your financial situation, ensuring you make the most of available deductions and credits while staying compliant with tax laws.

Final Thoughts

Understanding the tax brackets for 2023 is crucial for making informed financial decisions. By knowing how your income is categorized and taxed, you can take advantage of various strategies to manage your tax liability and optimize your financial well-being.

Remember that tax laws can change, so staying informed about the latest updates and seeking professional advice is key to maintaining financial stability and minimizing tax-related stress.

As you navigate the tax landscape, remember that the information provided here is based on the latest available data. Always refer to official IRS publications or consult a tax professional for the most accurate and up-to-date information.