Can I Salary Sacrifice My Rent?

Understanding Salary Sacrifice

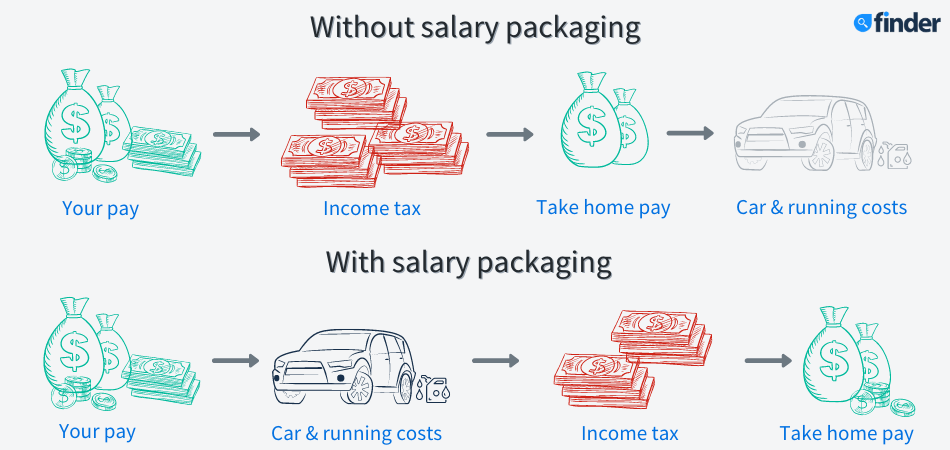

Salary sacrifice is a financial arrangement in which an employee agrees to forgo a portion of their pre-tax salary in exchange for certain non-cash benefits provided by their employer. This arrangement can offer tax advantages to both employees and employers. Common examples of salary sacrifice benefits include contributions to superannuation (retirement savings), the purchase of company shares, and the use of a company car. But can you salary sacrifice your rent? In this article, we’ll explore the concept of salary sacrificing rent and the potential benefits and limitations associated with it.

Can I salary sacrifice my rent?

The Basics of Salary Sacrifice for Rent

Salary sacrificing rent is not a common practice, and it’s important to understand the limitations and requirements involved. In some cases, employers may offer a form of rental assistance as an employee benefit, but this is distinct from traditional salary sacrifice arrangements. Here are some key points to consider:

1. Employer’s Discretion:

- Salary sacrifice arrangements are typically at the discretion of the employer. It’s up to your employer to decide whether they are willing to facilitate such an arrangement.

- If your employer offers rental assistance as a benefit, it may be separate from your regular salary and not counted as part of your salary package.

2. Fringe Benefits Tax (FBT):

- In many countries, including Australia, providing rent assistance as a fringe benefit may be subject to Fringe Benefits Tax (FBT).

- Employers are generally required to pay FBT on the value of fringe benefits provided to employees, and this cost may influence their willingness to offer rental assistance.

3. Tax Implications for Employees:

- If you can arrange a salary sacrifice for rent, it may reduce your taxable income, resulting in potential tax savings.

- However, it’s crucial to consult with a tax professional or financial advisor to understand the specific tax implications in your country, as tax laws can vary widely.

4. Documentation and Agreements:

- If your employer agrees to a salary sacrifice arrangement for rent, it’s essential to document the agreement clearly.

- The agreement should outline the amount to be sacrificed, the duration of the arrangement, and any conditions or restrictions.

Eligibility and Considerations

Before pursuing a salary sacrifice arrangement for rent, consider the following eligibility criteria and factors:

1. Employer Policy:

- Check your employer’s policies and guidelines regarding salary sacrifice arrangements. Some employers may have established procedures for requesting such benefits.

2. Tax Implications:

- As mentioned earlier, the tax implications of salary sacrificing rent can vary by country and individual circumstances.

- Consult with a tax expert to assess how this arrangement will affect your overall financial situation.

3. Rental Agreement:

- Ensure that your rental agreement allows for third-party payments. Some landlords or property management companies may not accept rent payments from employers.

4. Financial Impact:

- Consider how salary sacrificing rent will impact your overall financial situation and whether it aligns with your long-term financial goals.

Alternatives to Salary Sacrifice for Rent

While salary sacrificing rent is not common, there are alternative ways to ease the financial burden of rental expenses:

1. Rent Assistance Programs:

- In some countries, government programs provide rent assistance to eligible individuals or families.

- Check whether you qualify for such programs in your area.

2. Negotiate with Your Employer:

- If your employer is not open to salary sacrificing rent, consider negotiating for other benefits or compensation that can help offset your housing costs.

3. Budgeting and Financial Planning:

- Implement effective budgeting strategies to manage your expenses, including rent.

- Seek financial advice to create a comprehensive financial plan that aligns with your goals.

Conclusion

While salary sacrificing rent is an option in some cases, it’s not a common practice and comes with various considerations, including employer discretion, tax implications, and eligibility criteria. Before pursuing such an arrangement, it’s essential to consult with your employer and seek guidance from financial and tax professionals to make an informed decision. Additionally, exploring alternative solutions and government assistance programs can provide viable options for managing your rent expenses

In summary, salary sacrificing rent may not be a widely available option, but understanding the basics of salary sacrifice and considering alternatives can help you make the best financial decisions for your housing situation. Always seek professional advice to navigate complex financial matters effectively. https://cbdtax.com.au/ashfield-tax-agent/