What is the Business Tax in Australia?

Australia is known for its robust and stable economy, making it an attractive destination for businesses both large and small. However, like most countries, Australia imposes taxes on businesses to fund public services and infrastructure. In this article, we will delve into the intricacies of business tax in Australia, including its types, rates, and important considerations for business owners.

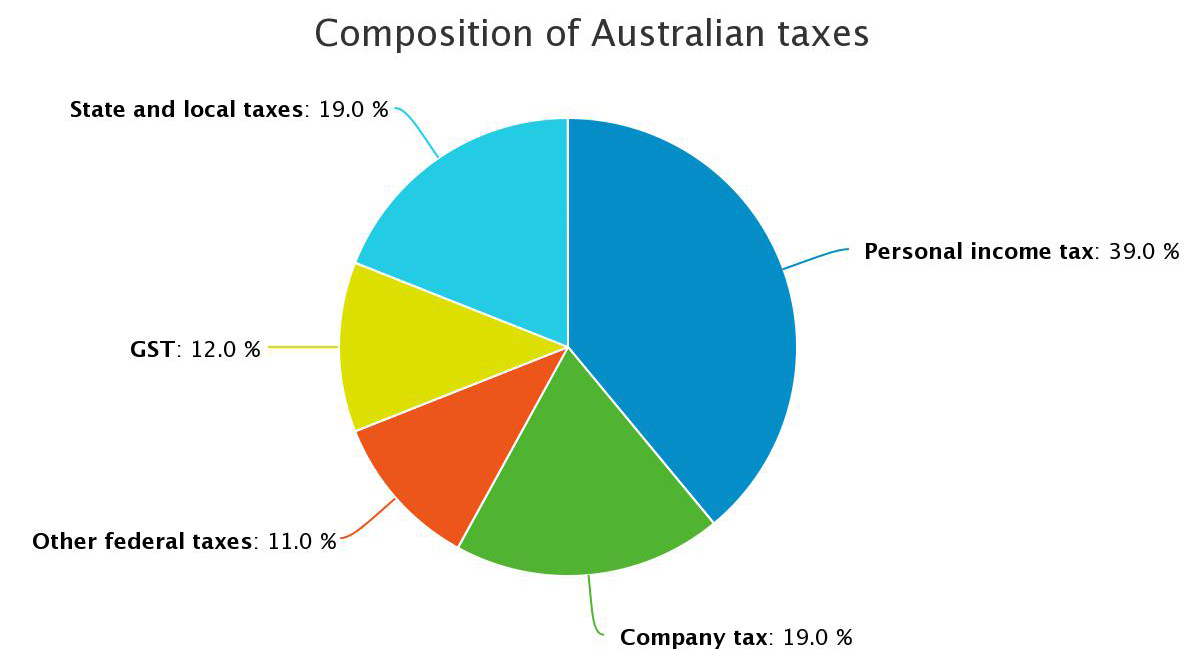

Types of Business Taxes in Australia

Australia has a multifaceted tax system, and businesses may be subject to various types of taxes, depending on their structure and activities. Here are the primary types of business taxes in Australia:

1. Income Tax

What is the business tax in Australia?

Income tax is one of the most significant taxes businesses in Australia must contend with. It is levied on the profits generated by businesses, and the rate varies depending on the type of business structure.

- Sole Traders and Partnerships: These entities are not considered separate from their owners, so they are taxed at the individual tax rates of their owners.

- Companies: Companies in Australia are taxed at a flat rate of 30% on their taxable income. However, small businesses with an annual turnover of less than $50 million can benefit from a reduced tax rate of 27.5% or 26% for the 2023-24 financial year, depending on their size and income.

2. Goods and Services Tax (GST)

GST is a value-added tax that applies to most goods and services in Australia. Businesses are required to collect GST on behalf of the Australian government and remit it periodically. The current GST rate in Australia is 10%.

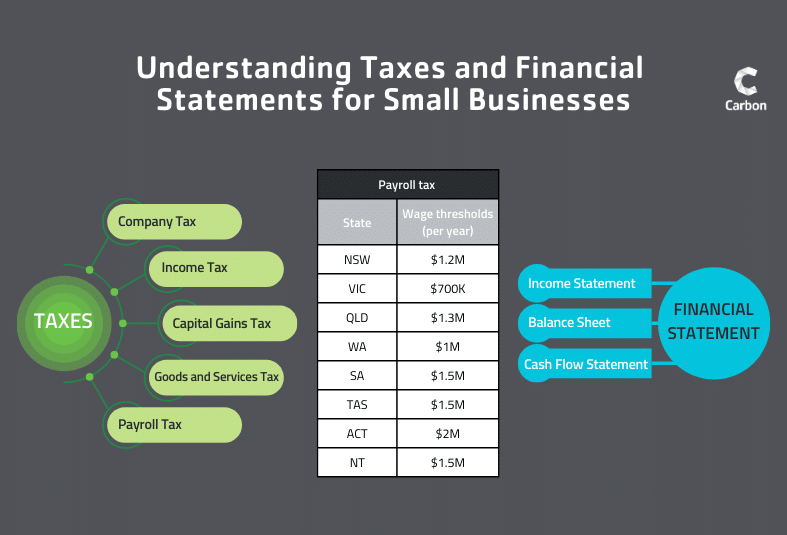

3. Payroll Tax

Payroll tax is imposed by state and territory governments and is based on the wages a business pays to its employees. The threshold and rates vary by state, so it’s essential for businesses to be aware of the specific rules in their location.

4. Fringe Benefits Tax (FBT)

FBT is levied on non-cash benefits provided to employees and is paid by the employer. This tax covers perks like company cars, entertainment expenses, and more. The FBT rate aligns with the top marginal tax rate, which is 45% for the 2023-24 financial year.

Business Tax Planning and Compliance

Compliance with Australia’s complex tax laws is crucial for businesses to avoid penalties and legal issues. Here are some essential considerations for business tax planning and compliance:

1. Record Keeping

Maintaining accurate financial records is essential for calculating and reporting taxes correctly. Businesses should keep detailed records of income, expenses, and other financial transactions.

2. Business Structure

Choosing the right business structure can have a significant impact on the amount of tax a business pays. As mentioned earlier, sole traders, partnerships, and companies are taxed differently in Australia. Business owners should consider their specific circumstances and consult with a tax professional to determine the most advantageous structure.

3. Tax Deductions

Businesses can reduce their taxable income by claiming deductions for eligible expenses. Common deductions include rent, wages, office supplies, and depreciation on assets. Staying informed about available deductions can help businesses minimize their tax liability.

4. Seeking Professional Advice

Navigating Australia’s tax system can be challenging, especially for newcomers or small business owners. Seeking advice from a qualified accountant or tax professional can help ensure compliance and potentially identify tax-saving opportunities.

Tax Incentives and Concessions

Australia offers various tax incentives and concessions to encourage business growth and investment. These incentives can vary by industry, location, and business size. Some notable incentives include:

1. Research and Development (R&D) Tax Incentive

Businesses engaged in eligible R&D activities can access tax incentives to offset some of their R&D costs. This program aims to stimulate innovation and competitiveness in the Australian economy.

2. Small Business Tax Concessions

Small businesses with an annual turnover of less than $10 million may be eligible for various tax concessions, including reduced income tax rates, simplified depreciation rules, and immediate deductions for certain asset purchases.

3. Export Market Development Grants (EMDG)

Businesses that export their products or services overseas can apply for the EMDG scheme, which provides financial assistance for marketing and promotional activities in international markets.

Conclusion

Understanding and managing business taxes in Australia is essential for the financial health and success of any enterprise. While the tax system may appear complex, seeking professional advice and staying informed about relevant tax incentives can help businesses navigate the terrain effectively. By adhering to tax laws and optimizing their tax strategies, businesses can thrive in Australia’s dynamic economic environment. https://cbdtax.com.au/