Understanding the $1500 Tax Offset: A Comprehensive Guide

What is a Tax Offset?

A tax offset, also known as a tax credit, is a reduction in the amount of tax an individual or business owes to the government. It is a valuable tool used by governments to encourage certain behaviors, stimulate economic growth, and provide relief to taxpayers. What is the $1500 tax offset?

The $1500 Tax Offset Explained

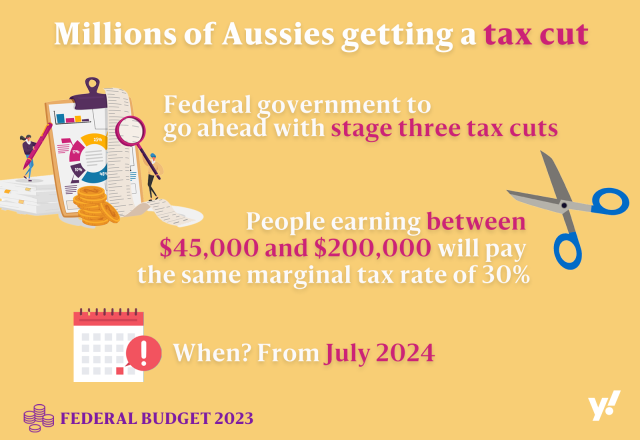

The $1500 tax offset, often referred to as the “Low and Middle Income Tax Offset” (LMITO), is a tax benefit introduced by the government to provide relief to low and middle-income taxpayers. It was designed to help ease the tax burden on individuals and families who fall within specific income brackets.

Eligibility Criteria for the $1500 Tax Offset

To qualify for the $1500 tax offset, taxpayers need to meet certain criteria:

- Be an Australian resident for tax purposes

- Have taxable income within the specified income range

- Have lodged an income tax return for the relevant financial year

The income range for eligibility can vary from year to year and is determined by the government. It’s important to check the latest information provided by the Australian Taxation Office (ATO) to confirm your eligibility.

Calculating the Tax Offset

The amount of the $1500 tax offset is not a fixed value. It depends on your taxable income and can vary from person to person. Generally, the offset reduces as your income increases. The ATO provides a set of guidelines and tools to help you calculate the specific tax offset you may be eligible for.

Claiming the Tax Offset

Claiming the $1500 tax offset is a straightforward process. When you lodge your annual tax return, the ATO will automatically calculate the offset based on the information you provide. If you’re eligible, the offset will be applied to reduce the amount of tax you owe or increase your tax refund.

The Benefits of the Tax Offset

The offset provides several benefits:

- Financial Relief: The offset offers financial relief to low and middle-income individuals and families, allowing them to keep more of their hard-earned money.

- Stimulating Spending: By putting more money in the pockets of taxpayers, the offset can stimulate spending and boost consumer confidence, contributing to economic growth.

- Support for Families: The offset can be particularly helpful for families with limited financial resources, assisting with everyday expenses.

Conclusion

The offset is a valuable initiative that provides much-needed relief to low and middle-income taxpayers in Australia. It serves as a mechanism to promote economic growth, support families, and reduce the financial burden on those who need it most. If you believe you may be eligible for this tax offset, make sure to consult the latest information from the ATO and consider seeking professional tax advice to ensure you receive the benefits you’re entitled to. For tax brackets CBD tax see here.