Who Paid the Most Tax in Australia?

An Overview of Australia’s Tax System

Australia has a progressive tax system where individuals and businesses pay varying amounts of tax based on their income and profits. The Australian Taxation Office (ATO) is responsible for collecting taxes and ensuring compliance with the tax laws. Every year, the ATO releases data on the highest taxpayers in the country, shedding light on the individuals and corporations that contribute the most to the nation’s tax revenue. For CBD tax advice see here.

The Top Individual Taxpayers

When it comes to individual taxpayers, the ATO’s data reveals some notable names who have paid substantial amounts of tax in Australia. One such prominent figure is Gina Rinehart, an Australian mining magnate and businesswoman. Rinehart’s extensive mining interests have earned her significant wealth, resulting in substantial tax contributions. However, due to privacy laws, the exact figures of individual taxpayers are not publicly disclosed.

Other high-profile individuals who have consistently featured among the top taxpayers include prominent business leaders, entrepreneurs, and entertainers. These individuals often have substantial incomes and pay a significant proportion of their earnings in taxes.

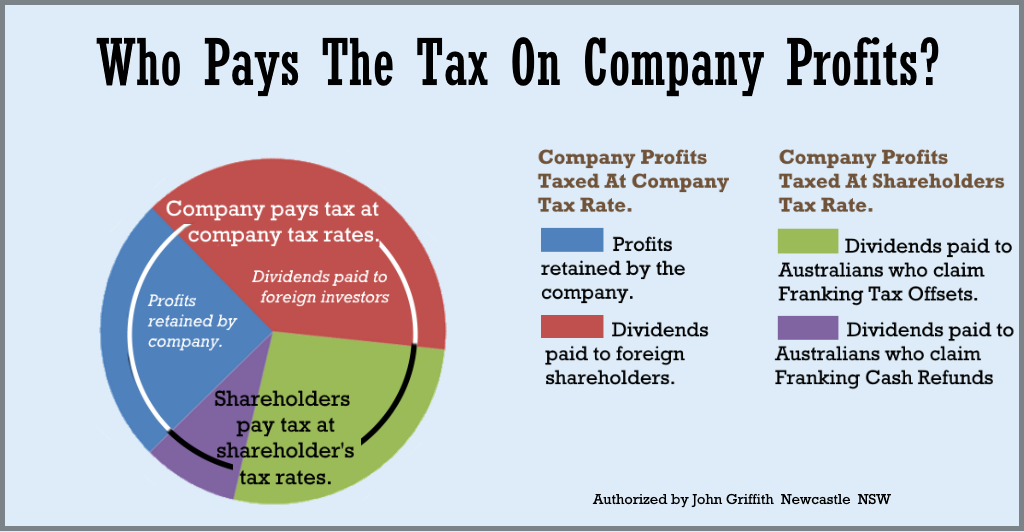

The Contributions of Large Corporations

In addition to individual taxpayers, large corporations play a crucial role in Australia’s tax revenue. Some of the biggest corporations operating in Australia make substantial tax payments each year. However, it is worth noting that the exact amount of tax paid by individual corporations is not always disclosed in the ATO’s data.

Despite privacy considerations, there have been instances where the tax payments of certain multinational corporations have come under scrutiny. In recent years, the Australian government has focused on combating tax avoidance by multinational companies and ensuring that they pay their fair share of tax.

One example of a company that has faced public scrutiny regarding its tax contributions is Apple. In 2019, Apple agreed to pay approximately AUD 85 million in back taxes to the Australian government after an investigation into its tax practices. This case sparked a broader conversation about the taxation of multinational corporations and the need for international tax reforms.

The Importance of Tax Contributions

The tax payments made by individuals and corporations are vital for funding essential public services and infrastructure in Australia. These tax dollars are used to support healthcare systems, education, defense, social welfare programs, and various other government initiatives.

It is essential to acknowledge the contributions made by high-income individuals and corporations, as they play a significant role in supporting the nation’s economy and society as a whole. However, it is equally crucial to ensure that everyone pays their fair share of taxes and that tax avoidance and evasion are effectively addressed.

Conclusion

Australia’s tax system relies on the contributions made by individuals and corporations to fund public services and infrastructure. While the exact figures of the highest taxpayers are not publicly disclosed, prominent individuals and large corporations are known to make substantial tax payments each year. This ensures the continued functioning of essential services and the overall well-being of the country.